Amplifying Savings: CT's Solar Incentives

Yarde Metals; CT; solar capacity 842.9 kW

Yarde Metals; CT; solar capacity 842.9 kW

BRIGHTFEEDS, BERLIN, CT

Program overview

Small project category :

Medium project category:

Additional notes on NRES,

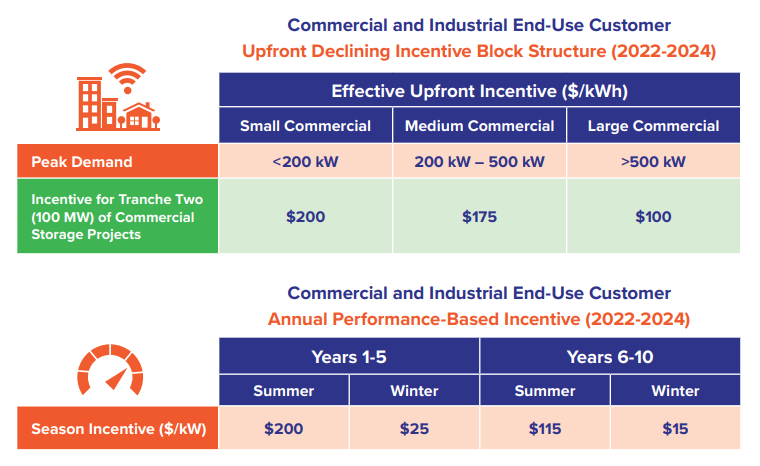

Overview: Energy Storage Solutions is designed to help businesses as well as public and nonprofit organizations install battery storage systems, lower peak demand at their facilities, and reduce energy costs. The program changes the economics of battery storage in Connecticut while aiming to modernize and stabilize the state’s electric grid.

*This program is overseen by the Public Utilities Regulatory Authority (PURA), paid for by ratepayers, and administered by the Green Bank, Eversource, and UI.

Information courtesy: portal.ct.gov

Even if an immediate investment in solar energy isn’t on your plan, we can still support you.

Through a Power Purchase Agreement (PPA), your solar project can receive financial support from a third-party investor like Solect. Here’s how it works: Solect leases your property to develop, own, and manage a solar energy system on it. In exchange, you purchase the electricity generated at a substantially lower and fixed rate for an agreed-upon period, typically 20 to 25 years.

Additionally, Solect partners with PowerOptions, the largest energy-buying consortium in New England for public and non-profit entities, to offer a Solar and Storage Program with several advantages beyond a standard PPA – from faster system deployment, easier management to maximized savings, and more.

Assess project site(s) and current and future electric profile

Present analyses and recommendations on financial benefits

Contract, engineer, and

develop

Construct, interconnect,

and commission projects

Optimize your solar ROI

with cutting-edge O&M services

Asset and performance management

and compliance