Taking advantage of upfront incentives from government and utility programs, businesses in the Northeast are rapidly adopting electric technologies for buildings, industrial processes, and vehicle fleets, reducing their dependence on fossil fuels. This shift—primarily driven by the need to enhance operational efficiencies, achieve sustainability goals, and comply with evolving regulations—is transforming how companies approach capital planning and energy consumption. Despite the reduced upfront costs and promises of technological advancements, this growing reliance on electricity can lead to huge increases in operational expenditures (OPEX) due to ‘double trouble.’ This article explores the concept of ‘double trouble’ and shows how strategic implementations of solar and energy storage solutions can help control these costs while enhancing the sustainability benefits of electrification.

What Is “Double Trouble”?

‘Double trouble’ illustrates a potential financial obstacle of electrification. As businesses adopt more electric technologies, their electricity consumption rises a lot leading to higher supply charges on their electric bills, as these charges are directly tied to usage. Additionally, to support widespread electrification, utilities must invest in grid infrastructure upgrades, including substations, transformers, cables, and overhead lines. These necessary enhancements are costly, and utilities in the Northeast have indicated that these expenses will be passed on to customers through higher electric rates. For example, in Massachusetts, Eversource and National Grid, are seeking rate hikes over five years to help finance about $2.4 billion in improvements, while three New Jersey utilities are seeking approval for rate hikes over five years to finance more than $1 billion in improvements. Consequently, businesses face a dual financial challenge: higher electricity usage coupled with rising rates, which together could place an ongoing strain on operating budgets, epitomizing the ‘double trouble’ scenario.

Electrification: The Source Matters

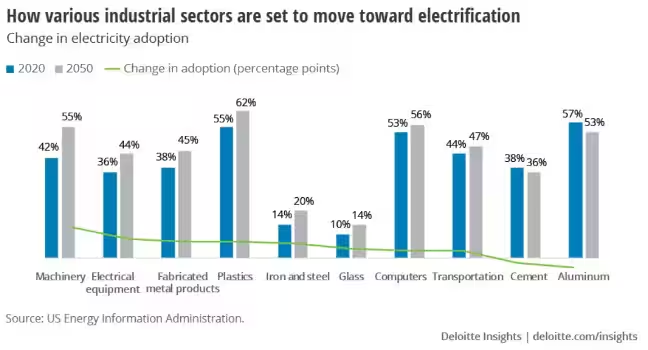

While the shift towards electrification varies from one industry to another, each industry has made strong progress, and most expect to continue to increase their electrification. Notably, the machinery manufacturing sector is poised to stay ahead of the curve in electrification adoption. That sector sourced 42% of their energy requirements from electricity in 2020, and it is expected to increase this share to 55% by 2050.

This trend toward electrification is accelerating across three key areas for most industries:

- Buildings: Electric-powered heating and cooling systems in facilities.

- Industrial Processes: Electric motors for compressors, elevators, and pumps.

- Transportation: Electric vehicles (EVs). forklifts, and tugs.

It’s important to recognize that the source of electricity influences its environmental impact. While replacing inefficient boilers with electric heat pumps and installing EV charging stations can improve operational efficiency, the overall environmental benefits are diminished if the electricity used is generated from carbon-intensive sources like natural gas power plants. This highlights the importance of pairing electrification efforts with a transition towards cleaner energy sources to maximize their environmental benefits. By installing solar panels on rooftops and solar canopies, businesses can generate renewable, on-site power and reduce use of expensive, brown, grid-supplied electricity.

Incorporating Solar into Capital Planning

Capital planning for electrification should include investments in solar and energy storage to enhance both the financial and sustainability benefits of electrification, while also taking advantage of federal and state solar incentives. Apart from wind turbines (which are challenging to site), solar is the most effective technology for controlling OPEX over the lifespan of electric-powered equipment.

Organizations interested in onsite solar but concerned about the additional cost of capital can talk to Solect about a solar site lease or a power purchase agreement (PPA). With these two financing models, Solect finances, builds, and operates the solar array on your property for an extended period, typically 20 to 25 years. With the solar site lease option, Solect pays you regular lease payments. With a PPA, Solect sells you the electricity generated at a low, fixed rate, offering a predictable energy cost over time.

Project Profile: North Atlantic Corporation

North Atlantic Corp (NAC), one of the largest millwork manufacturers and distributers in New England, decided it was time to tackle their escalating energy expenses. They chose onsite solar as their solution and partnered with Solect Energy to design and install a 1.5 megawatt solar array on the expansive roof of a NAC warehouse in Somerset, Massachusetts. In May 2017, their solar array went live, generating enough power to cover about 90% of NAC’s electric demand. Over seven years, NAC has saved more than $1.8 million in avoided costs from grid-supplied power.

It made sense to move forward with solar due to current legislation and a reasonable payback.

Karl Almond, Senior Project Manager, North Atlantic Corp.

Solect Energy: Your Partner in Solar & Energy Storage

Since 2009, Solect Energy has been a leading provider of solar and energy storage for companies, municipalities, universities, and nonprofits with 750+ installations totaling 150+ megawatts in the Northeast. Our extensive expertise spans participating in industry working groups to inform regulations, advising clients on effective strategies for onsite solar and energy storage, designing and building projects, and providing ongoing operations and maintenance services to ensure that solar investments deliver lasting value. We offer a no-cost initial consultation to explore how solar energy could benefit your organization. This includes evaluating your current and future electric usage, analyzing site eligibility for solar, and modeling project financials with all eligible federal and state incentives.

Taking Charge of Electrification

Ultimately, electrification is an opportunity for businesses to capitalize on upfront incentives, improve operational efficiency, and enhance sustainability. Although the financial implications of increased electricity usage and rising rates can be consequential, effective strategies exist to proactively manage these impacts. By embracing electric technologies and renewable energy, and partnering with Solect, companies can take control of their energy future and establish a sustainable path forward.

Next Steps

Contact us today for an initial consultation. Email info@solect.com, call 508-598-3511, or submit form to get started.

Sources

Electrification in Industrials: Transitioning to a lower-carbon future through electrification of industrial processes, spaces, and fleets (Deloitte Insights)

Eversource, National Grid seek hikes to upgrade the grid to handle surge in electrification (Boston Globe: February 16, 2024)

NJ utilities say spend $1B more for energy efficiency (NJ Spotlight News: November 13, 2023)

July 19, 2024