By Matt Shortsleeve, SVP of Marketing & Policy, Solect Energy

With more than 15 years of experience building solar and storage projects across Massachusetts and the Northeast, Solect has seen the energy landscape evolve through growth, challenges, and transition. SMART 3.0 marks a truly positive turning point — a comprehensive effort to revitalize the solar market by accelerating deployment and delivering long-term economic value to project participants and the state’s economy.

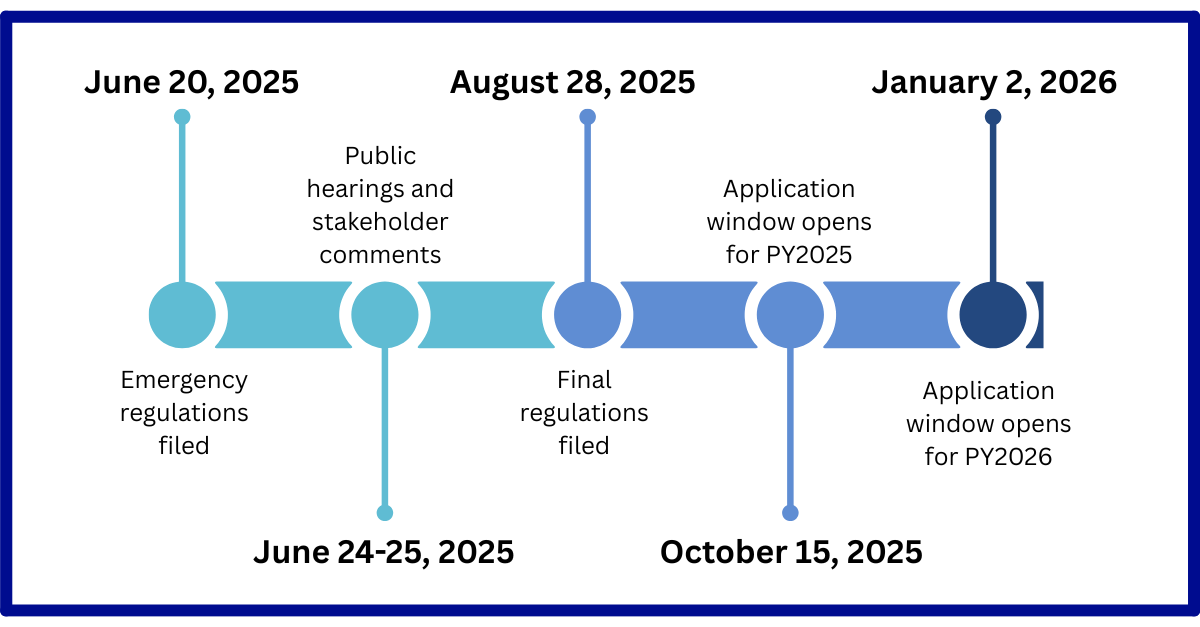

On August 28, 2025, the Massachusetts Department of Energy Resources (DOER) finalized SMART 3.0 under 225 CMR 28.00, the state’s solar program regulations, with an effective date of September 12, 2025. This followed emergency regulations filed on June 20, 2025, which initially launched SMART 3.0.

This phase of SMART arrives at a critical time. Massachusetts has slipped from a top-five solar state to 26th in new installations, with more than 1 gigawatt (GW) of projects stalled due to interconnection delays and low SMART 2.0 compensation rates. At the same time, the federal government is sunsetting incentives for renewable technologies, including solar. Against this backdrop, DOER acted boldly to stimulate new solar and energy storage projects in the state.

It’s both a policy shift and an opportunity that businesses, property owners, and public entities are ready for.

A Reset for Solar and Storage in Massachusetts

SMART 3.0 is designed to deliver both broad economic benefits and clean energy expansion. The Healey-Driscoll Administration has made it clear: solar is no longer just a climate solution. It’s one of the most effective tools we have to lower electricity costs, strengthen grid reliability, and create jobs.

Solar is one of the fastest and cheapest forms of energy we can bring into Massachusetts right now. I want us moving as fast as states like Florida and Texas on this because it will increase reliability and bring down the cost of electricity.

Governor Maura Healey

According to the Commonwealth, Massachusetts ratepayers could save $15–$20/month on their electricity bills by 2027 through the retirement of outdated solar carve-out programs and changes to net metering compensation. That’s nearly $1.5 billion in cumulative savings over five years.

The SMART 3.0 framework brings a new approach: incentives are now adjusted annually using a cost analysis to set levels, and the program prioritizes rooftop, canopy, and brownfield projects. It’s clear that Massachusetts is aiming to lead again — not just in megawatts installed, but in how clean energy policy delivers value for people, businesses, and communities.

SMART 3.0 Enrollment Opens This Fall

SMART 3.0 opens with two enrollment windows. The first begins October 15, 2025, for Program Year 2025, with 900 megawatts (MW) of statewide capacity and no cap for behind-the-meter projects <250 kW AC. This helps ensure there is enough available capacity to meet the deadlines tied to the sunsetting federal Investment Tax Credit (ITC).

The second enrollment period opens on January 2, 2026, kicking off the two-week window for Program Year 2026.

Key Program Dates

Key Changes in SMART 3.0

SMART 3.0 reflects a shift toward a more transparent, market-responsive approach. Here are some of the most notable changes.

SMART 2.0 vs. SMART 3.0 Comparison

| Feature | SMART 2.0 | SMART 3.0 |

| Incentive Structure | Declining Block | Annual Adjustment |

| Application Timing | Rolling | 2-week period in January (or until capacity is reached) |

| Waitlist | None | Yes. DOER may reallocate unused capacity |

| Storage Requirement | Required ≥500 kW | Required ≥1 MW greenfield ground-mounts |

Additional program innovations:

- $50,000/acre greenfield mitigation fund, reinvesting fees from ground-mounted projects into land conservation and biodiversity

- New >900 kW AC rooftop adder to boost incentive value for large building-mounted systems

- New rooftop raised racking adder

- Expanded eligibility for municipal aggregation low-income community solar

A Quick Example of Incentive Value

To illustrate how this works in practice: a 250 kW AC rooftop system in Program Year 2025 qualifies for the base rate of $0.2821 per kilowatt-hour, plus a $0.03/kWh adder for being building-mounted. That brings the total to $0.3121/kWh in incentives — adding up to more than $100,000 per year and over $2 million across the 20-year tariff term.

Projects that are installed behind-the-meter earn incentive payments for 20 years in addition to savings realized by offsetting the costs of grid-delivered electricity.

Who Can Benefit and How

SMART 3.0 is structured to deliver value across sectors — from private businesses to schools, municipalities and state agencies.

- Property owners can purchase a solar system to save on electric bills while receiving 20 years of incentive payments from the utilities, or lease their rooftops for long-term rental income.

- Offtakers of bill credits can save directly on their electric bills.

- Schools, municipalities, and nonprofits can use power purchase agreements (PPAs) to secure energy cost savings without upfront investment, while those with available capital funds can still choose direct ownership.

For system owners with solar installed 15+ years ago, SMART 3.0 introduces new repowering incentives that make it possible to upgrade legacy systems with more efficient technology and requalify for Utility incentive payments for the next 20 years.

How to Capture SMART 3.0 Incentives

SMART 3.0 sets clear expectations for project readiness, ensuring program capacity goes to projects that are further along in development.

- Public sector applicants (schools, municipalities, and state agencies): eligibility requires only an executed Letter of Intent with site control.

- Private sector applicants: eligibility requires an executed Interconnection Agreement with the utility.

- Ground-mount projects: must also secure all non-ministerial permits, such as planning board and conservation commission approvals.

SMART 3.0 + Federal ITC: Timing Is Key

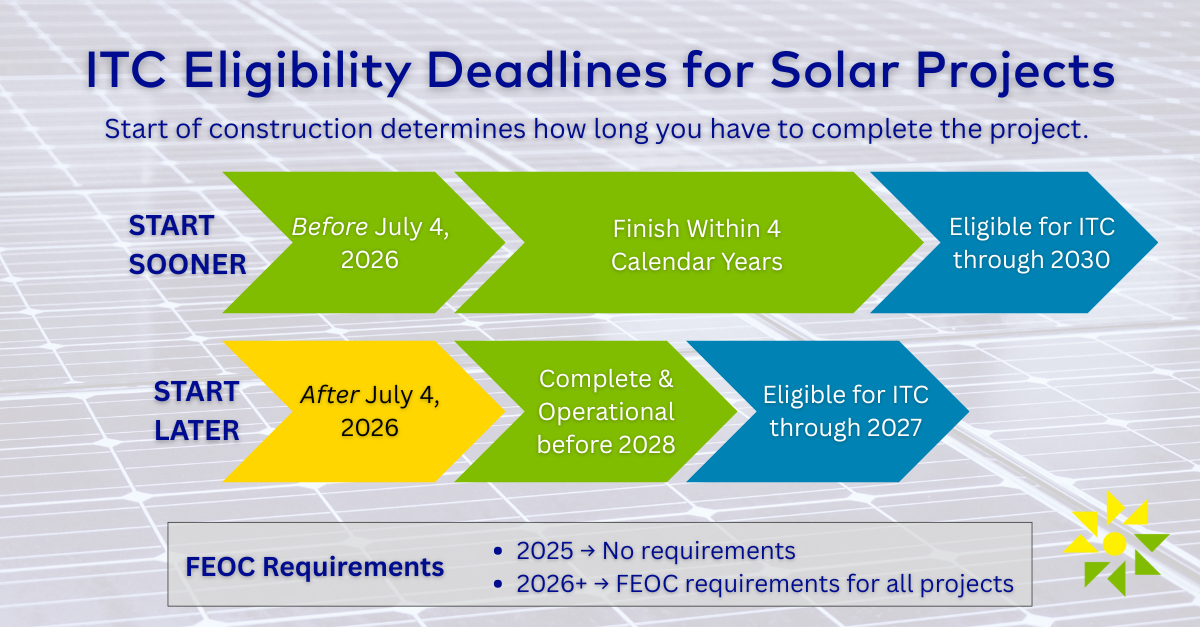

The federal Investment Tax Credit (ITC) remains one of the most valuable incentives, covering 30% or more of eligible project costs. For example, on a $1 million project, the ITC can offset $300,000 or more in capital costs. But it has been eliminated, with a phase-out schedule now in place. By aligning a project with both SMART 3.0 and the ITC, organizations can secure a powerful stack of incentives that reduce upfront costs and improve long-term return on investment.

Key ITC Deadlines

- Solar projects that start construction before July 4, 2026, are eligible for the ITC, with up to four full calendar years from the start date to finish construction and claim the tax credit.

- Solar projects that begin construction after July 4, 2026, can still qualify, but only if they are completed and operational by December 31, 2027.

This creates a clear inflection point: moving quickly provides more time and flexibility to capture the ITC.

Foreign Entity of Concern (FEOC) requirements start January 1, 2026. Projects safe-harbored before the end of 2025 are exempt, but projects not safe harbored in 2025 must use FEOC-compliant equipment.

At Solect, we’ve already taken steps to help our customers preserve maximum value. As a wholly owned subsidiary of Pattern Energy, Solect has invested in tens of megawatts of equipment for future projects. Contracts and payments made in 2025 will draw from this wider pool of lower-cost, non-FEOC equipment. For projects contracted in early 2026, we will provide FEOC-compliant equipment to retain ITC eligibility. While this equipment is expected to cost more due to import tariffs and limited U.S. solar production capacity, Solect’s financial strength ensures our customers can still access qualifying equipment and realize strong project economics.

With ITC deadlines and FEOC requirements approaching, preparation is critical. Organizations should:

Engage a qualified solar development company

Conduct feasibility assessments at their properties

Identify priority projects and contract for installation

Storage Now Plays a Central Role

Under SMART 3.0, projects 1 MW and larger must include battery storage, with limited exemptions. This reflects Massachusetts’ push to build a more flexible and resilient grid.

Battery systems remain eligible for SMART 3.0 incentive adders and deliver added value for behind-the-meter customers by:

- Reducing peak demand

- Shifting load to lower-cost hours

- Securing federal tax credit for energy storage technologies

With over 500 MW of storage already deployed, and a state target of 5 GW by 2030, storage is becoming a central piece of Massachusetts’ energy infrastructure strategy, and a savings and income solution for owners and participants.

A Tailwind for Clean Energy in Massachusetts

For Massachusetts, SMART 3.0 marks the start of a new chapter — one that links clean energy expansion with cost savings, grid reliability, and broad community benefits. Organizations that act now will be well positioned to maximize their return on investment and lower operating costs, while helping advance the Commonwealth’s next era of clean energy leadership.

For more than 15 years, Solect has helped organizations across Massachusetts turn clean energy into long-term value. Now, with SMART 3.0 in place, we’re ready to help lead this next chapter — guiding organizations through policy changes, capturing all available incentives, and securing a more resilient clean energy future.

About the Author

Matt Shortsleeve, SVP of Marketing & Policy, Solect Energy

Matt has over a decade of experience in the solar industry and leads Solect’s marketing, legislative, and regulatory strategy. He has helped to develop hundreds of solar and storage projects across Massachusetts and is a strong advocate for policies that advance affordable clean energy and a modernized electric grid.

September 10, 2025